Employers

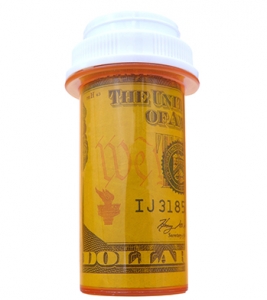

Last week, the U.S. Department of Treasury published final guidance on the Individual Shared Responsibility requirements, also known as the Individual Mandate. The Affordable Care Act (ACA) mandates that most U.S. citizens and permanent residents have a qualified health plan starting in 2014 or face financial penalties.

The Affordable Care Act (ACA) requires non-grandfathered plans to impose limitations on out-of-pocket expenses for essential health benefits starting in 2014. The out-of-pocket limitations will be capped next year at $6,350 for single coverage and $12,700 for family coverage.

However, some self-funded plans will be exempt from this requirement until 2015. The guidance indicates that self-funded plans contracting with multiple service providers can delay this requirement for one year.

On Monday, July 22nd, 2013, Governor Pat Quinn signed legislation that will expand the Medicaid program for residents of Illinois starting in 2014. Illinois is now the 23rd state that has decided to move forward with the expansion of its Medicaid program.

The Affordable Care Act (ACA) provides federal funds for states opting to expand its Medicaid program. Federal funds will pay for all of the costs to cover newly eligible people from 2014 to 2016. The federal funds will then start to gradually drop from 2017 until 2020 where it will level off at a 90% payment rate from that year and moving forward.

The public insurance exchanges are expected to introduce a new way for individuals to obtain health insurance coverage next year. However, with the introduction of these exchanges comes a number of complexities and nuances. That includes the topic of premium payment processing and late payments.

Individuals that qualify for Advanced Premium Tax Credits (APTC) through the exchanges will have a portion of their premium subsidized by the federal government, but the balance of the premium will be their responsibility.

The House of Representatives, controlled by the Republican Party, voted earlier this month to delay the Individual Mandate by one year. It voted 251-174 in favor of delaying the requirement for most individuals to obtain health insurance until January 1, 2015.

This marks the 38th time that the House has tried to repeal or scale back the Affordable Care Act (ACA).

The Exchanges are supposed to have verification systems in place to help determine if an enrollee has access to affordable health insurance coverage from their employer. Since the Employer Mandate reporting requirements are being delayed until 2015, the Exchanges won't have this verification system in place next year.

Instead the Exchanges will have to rely on self-reporting for this information in 2014.

By this time you have probably already heard that the Employer Mandate has been delayed until 2015. In simple terms, no employer will be penalized in 2014 for failing to offer health insurance (or failing to offer affordable health insurance).

Here are 5 key ACA items for employers to know.

The initial Patient-Centered Outcomes Research Institute (PCORI) fee for plan years ending after September 30, 2012 will be payable by July 31, 2013. Employers are required to pay this fee on plans that are considered to be self-insured.

Insurance companies will pay the PCORI fee on fully insured plans. However, the updated Form 720 in which the fees are paid gives the impression that employers are also responsible for this fee on fully insured plans.

Section 3210 of the Affordable Care Act (ACA) required nominal cost sharing to be added to Medicare Supplement Plans C & F. Under the current structure these Medicare Supplement plans eliminate nearly all of the cost sharing that is associated with Original Medicare.

It has been a common belief by many people that Plans C & F cause excessive and unnecessary utilization as a result of the limited cost sharing. The expectation was that Section 3210 would modify Plans C & F to include some form of a front-end deductible to encourage more appropriate uses of physician services.

Millions of Americans Countdown to October 1st

Less than 3 months from today marks the start of the 6 month open enrollment period under the Affordable Care Act (ACA). As officials scramble to promote the new healthcare reform enrollment season, we at Flexible Benefit Service LLC (Flex) have been keeping up-to-date with the fluid changes of rules and regulations contained within the growing law.