Happy employees are better employees. They’re more engaged in their work, more loyal to their employers, and make more meaningful contributions toward company goals. That’s not surprising.

However, today’s employees have different expectations for what makes them happy. In an always-on world, where work and life blend together, employees are looking for fulfillment in their work, personal lives, and relationships. Employers who recognize their employees’ need for flexibility and support, both at the workplace and beyond, are poised to reap the benefits in a competitive hiring market.

MetLife’s recently released 17th Annual U.S. Employee Benefit Trends Study dives into the new work-life world to examine how employers can attract, engage, and retain the best talent by helping employees thrive in work and in life. This year’s research focuses on five key findings and their implications for employers, employees and intermediaries:

- When employees are supported as individuals, they are more engaged

- Finding purpose at work is multifaceted

- Technology is driving a new mandate for training

- Flexible careers are reshaping the workplace

- The gig economy can be a challenge and an opportunity for employers

Benefit strategies will play a pivotal role in helping employers and employees navigate the evolving landscape. The study’s findings offer powerful conversation starters for your client consultations.

Financial stress tops employee concerns

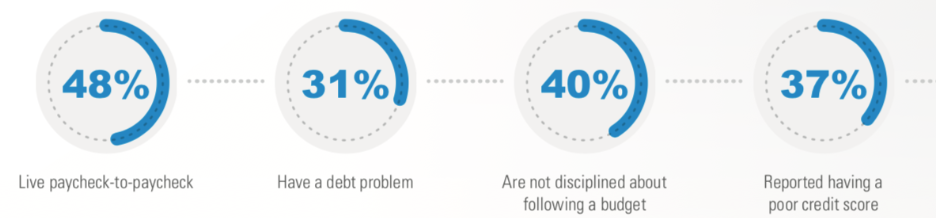

Everyday stress affects employee happiness and can distract from succeeding at work. Across life stages, the number one stress cited by employees is personal finances. Short-term concerns like having the money to pay bills or cover out-of-pocket medical expenses rank high. But, three of employees’ top five financial concerns relate to longer-term retirement worries.

One in three employees admits to being less productive at work because of financial stress. At the same time, two in three employees say the benefits available to them through the workplace help to reduce their financial concerns.

Employees value benefits options

Seventy-three percent of employers believe employees are satisfied with their benefits. That’s a slight over-estimation when compared to 67 percent of employees who say they’re satisfied with their workplace benefits. Notably, the employee percentage is a decline of four percent from 2018.

One area where employers and employees may not be on the same page is about benefits choices. Employees want benefits to meet their specific needs.

- 90% would be willing to take a small pay cut – about 3.8 percent on average – in order to have a better choice of benefits through their employers.

- 55% would be willing to bear more of the costs of benefits to have choices that meet their needs.

- 60% are interested in having a wider array of benefits available that they can purchase on their own.

With low unemployment and heightened competition for top talent, benefits can play an important role in helping employees – and the companies they work for – thrive.

Visit MetLife.com/EBTS2019 to explore these and other insights to help your clients offer relevant benefit solutions that attract and retain employees.