ACA

Insurance companies are concerned that some people are abusing the Special Enrollment Period (SEP) that is available in the individual marketplace. They have indicated at least some people are delaying enrollment in coverage until they get sick, applying for coverage only once they need it, and then canceling the coverage after treatment. They further argue that there aren’t enough rules in place to verify if a person actually experienced a qualifying event which would trigger a SEP.

- The Cadillac Tax has been delayed by two years until 2020.

- The Individual Mandate penalties increase to $695 per adult ($347.50 per child) or 2.5% of household income, whichever is greater.

- The Employer Mandate expands to include all employers who have 50 or more employees.

- The Employer Mandate offer rate increases from 70% to 95%.

- Employer reporting related to the offer of coverage is due for the first time during Q1 2016.

You may have thought the penalty for applicable large employers who fail to offer minimum essential coverage was $2,000 per employee. You may have also thought that if you offered coverage, but it was unaffordable and/or didn’t provide minimum value, then the penalty was $3,000 per employee who waived coverage and received a subsidy in the Exchange.

The new reporting requirements that some employers will be subject to starting next year, as required by the Affordable Care Act (ACA), will be used to help the Internal Revenue Service (IRS) enforce the Individual and Employer Mandates, and it will also help the IRS administer subsidy eligibility in the Exchanges.

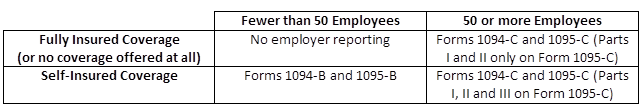

The following reporting forms will be the responsibility of the employer to complete:

The Protecting Affordable Coverage for Employees (PACE) Act, signed into law by President Obama on October 7, 2015 gives states the ability to continue to determine the size of their small group market rather than conforming to a national standard.

Most states currently define their small group market as employers with up to 50 employees, but the Affordable Care Act (ACA) was set to expand that definition in 2016 to include employers with up to 100 employees. The PACE Act allows each state to independently decide what small group market definition makes the most sense.