Affordable Care Act

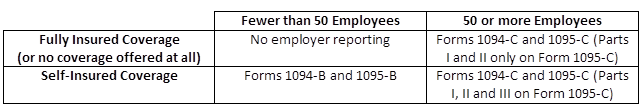

The new reporting requirements that some employers will be subject to starting next year, as required by the Affordable Care Act (ACA), will be used to help the Internal Revenue Service (IRS) enforce the Individual and Employer Mandates, and it will also help the IRS administer subsidy eligibility in the Exchanges.

The following reporting forms will be the responsibility of the employer to complete:

PCORI Fees

The Protecting Affordable Coverage for Employees (PACE) Act, signed into law by President Obama on October 7, 2015 gives states the ability to continue to determine the size of their small group market rather than conforming to a national standard.

Most states currently define their small group market as employers with up to 50 employees, but the Affordable Care Act (ACA) was set to expand that definition in 2016 to include employers with up to 100 employees. The PACE Act allows each state to independently decide what small group market definition makes the most sense.

The cost for failing to comply with the new reporting requirements of the Affordable Care Act (ACA) just got steeper. Under a trade bill signed into law by President Obama at the end of June, the penalties for failing to comply with the new reporting requirements, which are used to help the IRS enforce the Individual and Employer Mandates, have substantially increased.

Failing to complete the reporting: