Flexible Spending Accounts

- Make the tax code simple, fair and easy to understand.

- Give American workers a pay raise by allowing them to keep more of their paychecks.

- Bring back trillions of dollars that are currently kept offshore to reinvest in the American economy.

IRS Revenue Procedure 2017-58 was released last week. It includes a number of inflation adjustments to various benefits and other items for 2018 including the following for Consumer-Driven Accounts:

The fourth installment of the Patient-Centered Outcomes Research Institute (PCORI) fees will be due on July 31, 2016.

As its name suggests, PCORI is a research institute, and it was created by the Affordable Care Act (ACA) as a way to improve clinical effectiveness. It is partially funded by fees charged to health plans.

The following list contains information and some reminders about the upcoming PCORI fee that is due:

What happens to Health and Dependent Care FSAs when a merger or acquisition occurs?

Can an individual be covered by more than one “Flex Plan” at the same time?

Yes, Health Care Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs) can be combined in certain circumstances.

The Internal Revenue Service (IRS) recently issued long awaited guidance that details how someone can be Health Savings Account (HSA)-eligible the following plan year if they have access to funds that rollover from a Healthcare Flexible Spending Account (FSA) from the previous plan year.

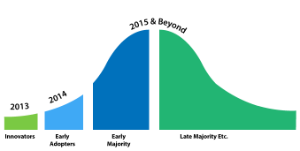

After nearly thirty years of lobbying the “Use-It-or-Lose-It” rule has been changed. Now the option is left to you, the plan sponsor, whether or not it is the right thing to implement for your company. Let’s take a look at some of the scenarios and helpful tips for the healthcare flexible spending account (FSA) rollover option in terms of an adoption lifecycle (a model that shows the trend of acceptance to a new concept over time).