Benefits Buzz

2015 and 2016 Employer Mandate Penalty Estimates

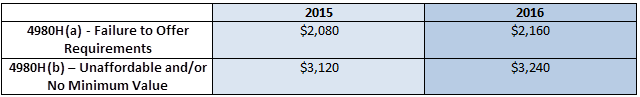

You may have thought the penalty for applicable large employers who fail to offer minimum essential coverage was $2,000 per employee. You may have also thought that if you offered coverage, but it was unaffordable and/or didn’t provide minimum value, then the penalty was $3,000 per employee who waived coverage and received a subsidy in the Exchange.

However, the Employer Mandate penalties are subject to inflationary adjustments per Section 1302(c)(4) of the Affordable Care Act (ACA). Section 1302(c)(4) indicates that the inflationary adjustments apply to calendar years after 2014, which is the year the Employer Mandate was originally supposed to take effect. As a result, it’s estimated that the penalties will rise accordingly:

Please note the regulators have not issued any formal guidance which confirm these increases, but the formula that is used in applying inflationary adjustments would estimate these to be the increased amounts. The percentage adjustment is based on the projections of average per enrollee employer-sponsored insurance premiums from the National Health Expenditures Accounts, as calculated by the CMS Office of the Actuary (OACT). These percentages are ~4.21% for 2015 and ~8.32% for 2016, and increases are rounded to the next lowest multiple of $10.

Note: All penalties are prorated on a monthly basis.

Subscribe to this blog at the top left navigation by entering your email address to learn more with Flexible Benefit Service LLC (Flex).

The materials contained within this communication are provided for informational purposes only and do not constitute legal or tax advice.