Benefits Buzz

2015 Medicare Plan Premiums

Posted on October 24th, 2014

We, at the Flex General Agency, are excited about this Medicare sales season and wanted to provide some general insight for insurance professionals regarding this booming marketplace.

Reminder: The 2015 Medicare Annual Open Enrollment Period started on October 15 and runs though December 7, 2014.

Part A (Hospital Insurance) – 99% of Medicare beneficiaries do not pay any premium for Part A because they paid Medicare taxes and/or were married to someone who did. No premium applies to those individuals or their spouses that have paid Medicare taxes for at least 40 quarters (10 years). Medicare beneficiaries who have paid taxes for 30-39 quarters can purchase Part A for $224/month. Medicare beneficiaries who paid taxes for 0-29 quarters can purchase Part A for $407/month.

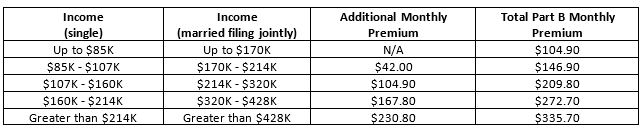

Part B (Medical Insurance) - Most people enrolled in Part B will pay a premium unless they also qualify for Medicaid or other state assistance. The standard premium for Part B is $104.90/month, but it increases for those individuals with higher incomes.*

Part C (Medicare Advantage) – Anyone that wants to sign up for a Medicare Advantage plan must also be enrolled in Part A and B and pay the applicable premiums. In addition, the insurance carriers offering Medicare Advantage plans may also charge a premium, although several carriers have plans with a $0 premium.

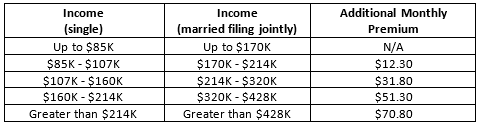

Part D (Prescription Drug Coverage) - Most people enrolled in Part D will pay a premium unless they also qualify for Medicaid or other state assistance. The premiums vary by carrier and plan, but the national average Part D premium is $33.13/month. Similar to Part B, higher income earners are charged a higher premium for Part D coverage in addition to the base premium.*

Medicare Supplements (Medigap) – Rates generally vary by age, carrier, plan type and applicants may be subject to underwriting.

*It should be noted that there is a separate premium table for higher income earners who are married but file their taxes separately.

Subscribe to this blog or join our mailing list to stay updated on healthcare reform and more with Flexible Benefit Service LLC (Flex).

The materials contained within this communication are provided for informational purposes only and do not constitute legal or tax advice.