Medicare

Employers often wonder if they can pay or reimburse employees for Medicare premiums if they waive coverage under the employer-sponsored group health plan. This may drive down the overall cost to the employer, and it may even be in the best interest of some Medicare-eligible participants; however, this type of action is generally prohibited under various laws.

It’s official. The Biden Administration announced the COVID-19 national emergency and public health emergency will end on May 11, 2023.

You may be familiar with Medicare’s annual enrollment period (AEP) which occurs each fall. From October 15th until December 7th of each year, Medicare beneficiaries can enroll in a Medicare Advantage or Part D plan of their choice. This includes enrolling in a plan for the first time or changing to a new plan.

Annual Medicare Part D reporting is required for all employers who provide health benefits with prescription drug coverage. The reporting is an online filing to the Centers for Medicare & Medicaid Services (CMS), and it lets CMS know if the prescription drug coverage available on the employer’s health plan is “creditable.”

The Centers for Medicare and Medicaid Services (CMS), the federal agency that largely oversees the Health Insurance Marketplace (Marketplace), has indicated that agents and brokers who assist with Marketplace enrollments must obtain client consent before assisting with enrollments and other Marketplace functions.

Earlier this year, the Centers for Medicare & Medicaid Services (CMS) published some new compliance rules that will impact Third-Party Marketing Organizations (TPMOs) who sell Medicare Advantage and/or Part D plans.

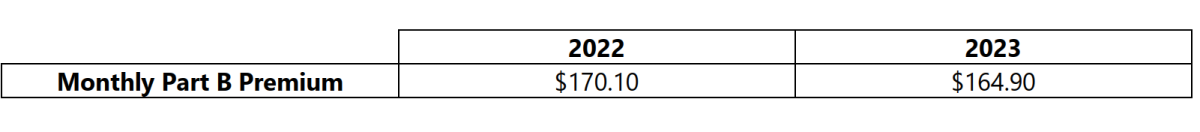

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers: