premiums

Employers often wonder if they can pay or reimburse employees for Medicare premiums if they waive coverage under the employer-sponsored group health plan. This may drive down the overall cost to the employer, and it may even be in the best interest of some Medicare-eligible participants; however, this type of action is generally prohibited under various laws.

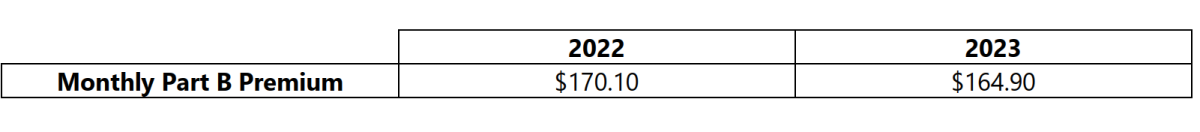

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers:

Each year, the Centers for Medicare and Medicaid Services (CMS) adjusts the premiums and out-of-pocket expenses for Medicare beneficiaries. Below is a summary of the 2019 costs.

Premiums

Part A: Most individuals don't have to pay a premium for Part A, however, those that do will generally have to pay $437 per month in 2019. This is an increase from $422 in 2018.

Flexible Benefit Service LLC (Flex) is excited to tell you about the 21st Century Cures Act which was signed into law by President Obama on December 13, 2016. While the law primarily focuses on healthcare innovations and enhancing medical research, it also created a new type of Health Reimbursement Arrangement (HRA), referred to as a "Qualified Small Employer HRA."