Deductible

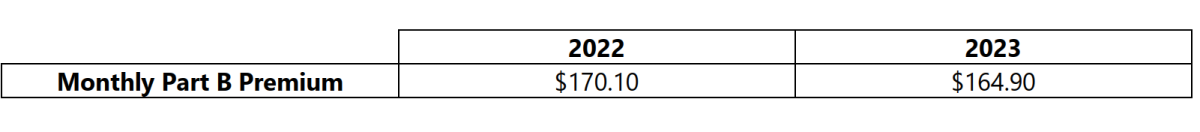

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers:

On April 1, 2014, President Obama signed into law the “Protecting Access to Medicare Act of 2014.” Although much of the law is designed to fix problems with the Medicare program, the law also included a repeal of the deductible limits that apply to small group health plans. In 2014, the Affordable Care Act (ACA) established deductible limits for health plans offered to small employers (defined as up to 50 employees in most states).

The U.S. Department of Health and Human Services (HHS) posted final regulations about the deductible and out-of-pocket limitations to the Federal Registrar on February 25, 2013. Section 1302(c) of the Affordable Care Act (ACA) specifies that the maximum deductible for a qualified insurance plan cannot exceed $2,000 for single coverage and $4,000 for family coverage.