Benefits Buzz

2023 Medicare Costs

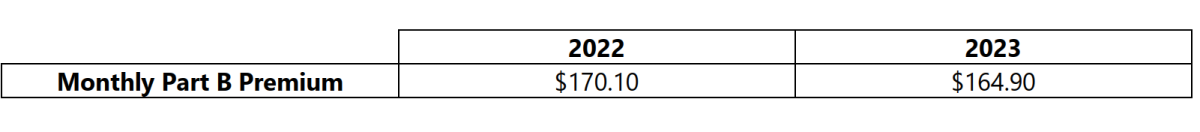

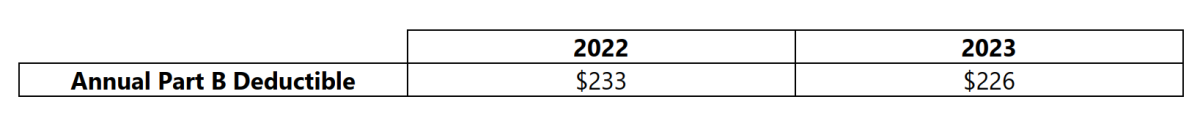

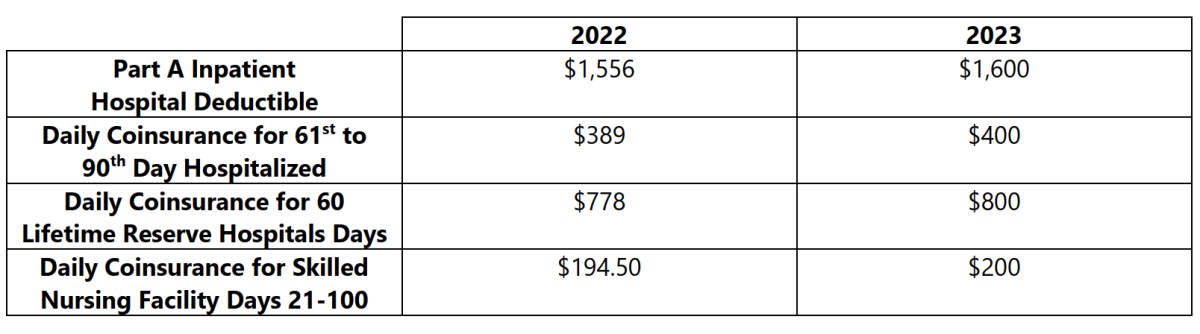

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers:

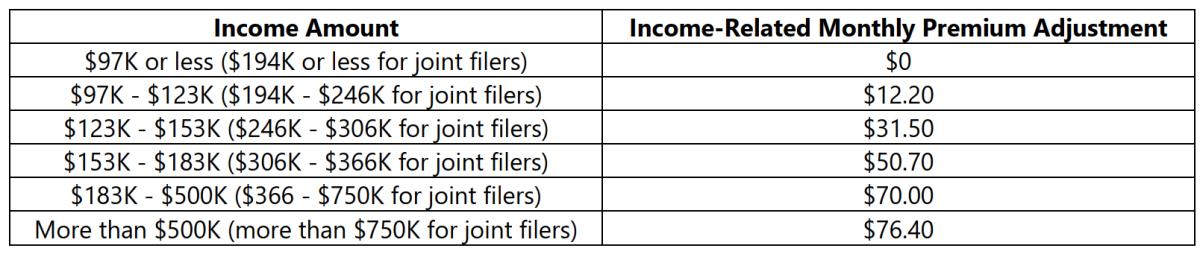

Please note the Part B premiums increase for individuals with earnings of more than $97,000 or joint tax filers with earnings of more than $194,000. The monthly Part B premium can be as much as $560.50 for high income earning individuals and families.

This is the amount of the out-of-pocket expense that must be paid for outpatient services (e.g., office visits) before the 80% coinsurance benefit under Part B begins. The deductible and/or coinsurance percentage may not be applicable to certain Medicare beneficiaries who are enrolled in a Medicare Supplement or Medicare Advantage plan.

Most individuals qualify for Part A without having to pay a monthly premium. Part A is premium free to individuals who paid Medicare taxes for 40 quarters (i.e., 10 years) or for individuals who were married to someone who paid Medicare taxes for 40 quarters.

Approximately 8% of Medicare beneficiaries pay a higher premium for Part D because of their income. These individuals will pay the base plan premium plus the additional amount in the table above. Part D covers prescription drugs.