Benefits Buzz

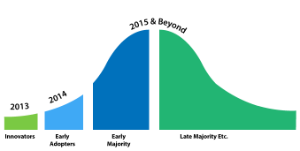

FSA Rollover Adoption Lifecycle for Plan Sponsors

After nearly thirty years of lobbying the “Use-It-or-Lose-It” rule has been changed. Now the option is left to you, the plan sponsor, whether or not it is the right thing to implement for your company. Let’s take a look at some of the scenarios and helpful tips for the healthcare flexible spending account (FSA) rollover option in terms of an adoption lifecycle (a model that shows the trend of acceptance to a new concept over time).

Scenario 1 – You’re an Innovator

You moved swiftly to amend your plan documents for 2013 to include the brand new $500 rollover option announced by the Department of Treasury last Halloween. Good for you!

Here’s some advice – It’s January and now those employees who would have forfeited their pre-tax savings now have up to 500 more reasons to learn how they can use their FSA. Don’t forget to remind them to use it. Also, make sure they are aware of all qualified health care expenses and the fact that it also covers their spouse and dependents.

Scenario 2 – You’re an Early Adopter

You heard the news announcement, but already had your plans ironed out for 2013. You may have even been ineligible due to an in-force grace period. But you know that 2014 will be the year to take this step for your company.

Here’s some advice – You can still amend your FSA for 2014 to allow the rollover. It’s also never too early to think of creative ways to boost participation for next year. If you know you’re ready for the rollover option, use your time wisely to plan and promote benefits of FSAs in health/benefit fairs throughout the year to increase awareness.

Scenario 3 – You’re Part of the Majority

Decisions like these are tough to make and all of the media buzz around this is not making it easier for you. Whether it is early or late majority – you want to see an established trend before you decide.

Here’s some advice – Make sure to watch the trends of companies that are not only the same size, but also in the same industry as your company.

Scenario 4 – Not the Right Fit for You

You may have decided that the rollover option is not quite the right fit for their company at this time.

Here’s some advice - If you have kicked the tires of this option and been advised against implementing it and your employees were looking for your company to make the move look into grace periods if you haven’t already. It may be a more feasible option for you. If not, make sure to communicate with employees the eligible expenses, deadlines and helpful tips that do apply to them.

View highlights from the Treasury-issued guidance >>

Only time will tell whether the adoption of the rollover is popular. Subscribe to this blog to stay updated on the latest in employee benefits or click here to learn about our solution, FlexFSA™.

Note: The materials contained within this communication are provided for informational purposes only and do not constitute legal or tax advice.