Benefits Buzz

ICHRA vs. QSEHRA: What's a Small Business to Do?

Small businesses often times find it hard to provide quality health insurance coverage to employees, especially during these unique times. Let’s face the reality! Health insurance usually comes with a high price tag, and small businesses may not be able to meet the contribution or participation requirements to provide a traditional group health plan to employees.

Enter Health Reimbursement Arrangements (HRAs).

There are two relatively new types of HRAs that allow small businesses an opportunity to create their own type of health plan. The Individual Coverage Health Reimbursement Arrangement (ICHRA) and Qualified Small Employer Health Reimbursement Arrangement (QSEHRA) allow employers to provide tax-free reimbursements to employees for health insurance coverage they obtain on their own.

ICHRAs and QSEHRAs allow employers to set maximum reimbursement limits while not locking employees into coverage offered under a specific plan, network, or insurance company. Sure, there are still some rules that must be followed, but ICHRAs and QSEHRAs let small businesses cap their healthcare costs while still providing a tremendous benefit to employees.

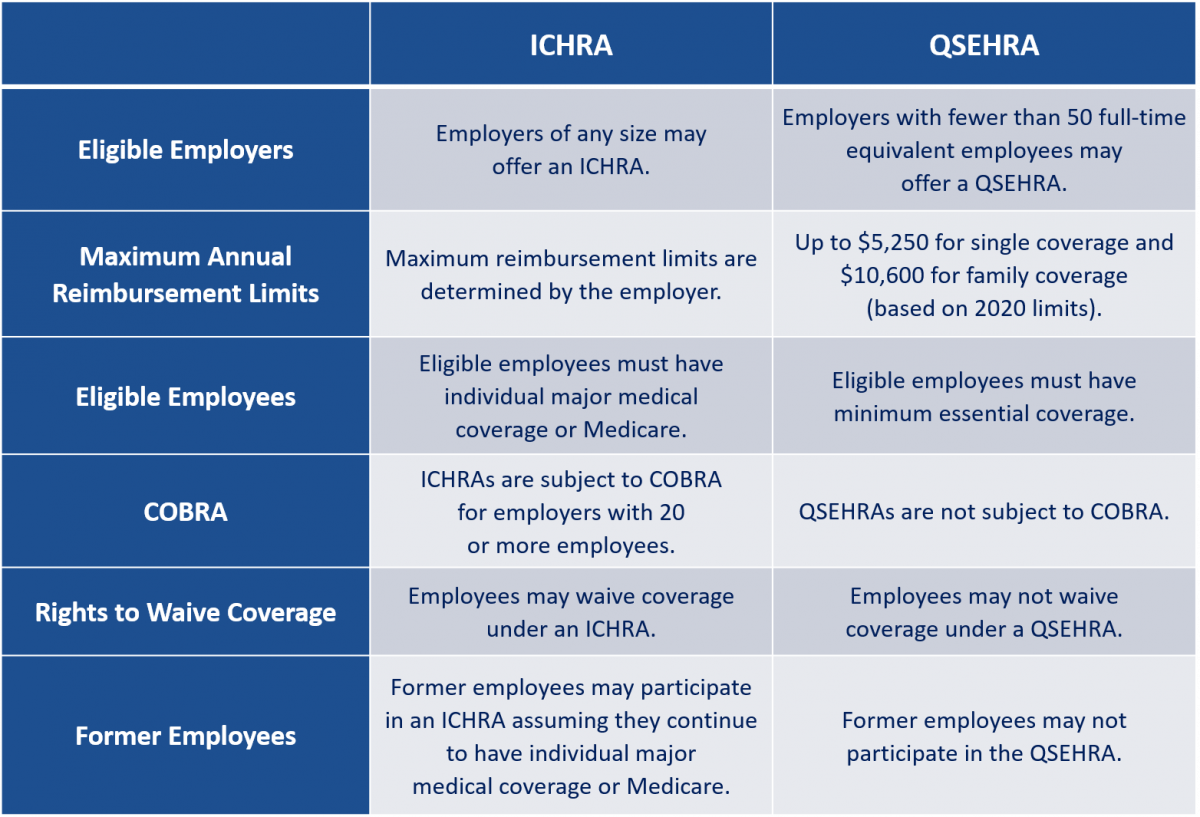

ICHRAs and QSEHRAs have a great deal of similarities, but there are some key differences small businesses should consider.

So, what are the differences between an ICHRA and a QSEHRA?

We've put together a helpful table to summarize the key differences.

Decisions, decisions. Flexible Benefit Service LLC (Flex) is here to help employers navigate the sometimes-complex health insurance market. Flex administers ICHRAs and QSEHRAs for many small businesses. Contact us today to learn more about these new options. Your employees will love it!

Looking for ICHRA or QSEHRA administration for your company?

Want to learn more? Visit our ICHRA page.