Benefits Buzz

IRS' Minimum Essential Coverage and Subsidy Guidance for Individuals

Posted on December 12th, 2014

Earlier this year the IRS released three revenue procedures (2014-46, 2014-37, 2014-41) which provide guidance to individuals on their obligation to maintain minimum essential coverage and includes information on subsidies available through the Health Insurance Marketplace (Exchange).

Notice 2014-46 addresses maximum penalty amounts for anyone that does not have minimum essential coverage and also does not qualify for an exemption. The maximum penalty for 2014 is $204/mo ($2,448/yr) with a maximum of five family members subject to the penalty.

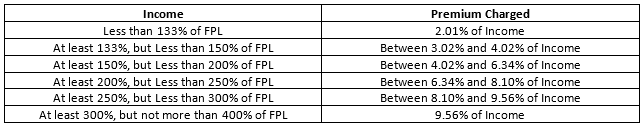

Notice 2014-37 provides information about the Advanced Premium Tax Credits (APTC) that are available in 2015 for eligible individuals. The APTC is directly tied to the second lowest priced Silver plan offered on the Exchange. The premium charged for this plan is based on a percentage of income in relation to the Federal Poverty Level (FPL). The table below outlines this information.

Notice 2014-41 discusses the ability for self-employed individuals and anyone with medical expenses in excess of 10% of their income to receive tax deductions for premiums and out-of-pocket expenses. The guidance states that only the non-subsidized premiums and medical expenses are eligible for a tax deduction.

View the full details of the IRS revenue procedures:

Subscribe to this blog or join our mailing list to stay updated on healthcare reform and more with Flexible Benefit Service LLC (Flex).

The materials contained within this communication are provided for informational purposes only and do not constitute legal or tax advice.