Benefits Buzz

STM Plans Not So Short Anymore

Posted on February 27th, 2018

In October 2017, President Donald Trump issued an executive order instructing the Department of Health and Human Services (HHS), Department of Labor (DOL) and Department of Treasury (DOT) – collectively known as the “tri-agencies” – to consider proposing rules that would expand short-term, limited duration insurance, also known as short-term medical plans (STM plans).

On February 20th, the tri-agencies responded and proposed a rule that would allow STM plans to have a maximum duration of less than 12 months, or 364 days. Guidance issued under the Obama administration limited the maximum duration of STM plans to less than 3 months, or 90 days. The new proposed rules are essentially a reversal of an Obama-era regulation and are available for public comment for 60 days.

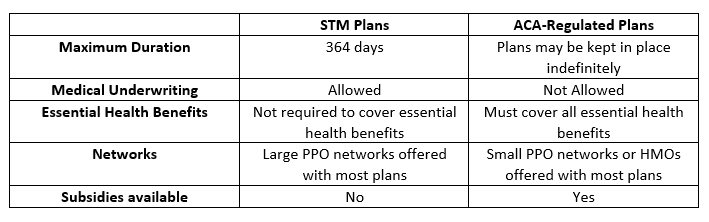

STM plans are exempt from the Affordable Care Act (ACA). These plans generally have a lower premium than permanent health plans sold on or off the Exchange, however, this is because they don’t cover the same benefits as ACA-regulated health plans and they can deny a person coverage based on their medical history. Below is a quick summary of some of the differences between STM plans and ACA-regulated health plans.

Additionally, STM medical plans are not considered “minimum essential coverage” which is a type of health insurance that is needed to avoid a penalty under the Individual Mandate. With the Individual Mandate penalty going away in 2019, there is a belief this will become a moot point and more people will flock towards STM plans.

Assuming the proposed rules are finalized as-is, it feels like the individual market is moving towards the way it was prior to the ACA. In the past, individual health insurance plans were subject to medical underwriting, and if someone was denied coverage they could enroll in a high-risk pool plan run by the state. With the new proposed rules and the elimination of the Individual Mandate penalty, it seems like the ACA-regulated plans could become the new high-risk pool plan for people that can’t qualify for a STM plan.