Benefits Buzz

ACA Employer Mandate Update

Posted on May 29th, 2018

The Internal Revenue Service (IRS) recently released Revenue Procedure 2018-34 which includes details about the affordability percentage related to the Employer Mandate for the upcoming year. In 2019, coverage will be considered affordable if the employee’s share of the premium for self-only coverage is no more than 9.86% of their household income. As most employers don’t know the household income of their employees, three alternative safe harbor methods may be used:

1. W-2 Safe Harbor Method: Coverage will be considered affordable if the employee’s share of the premium is no more than 9.86% of their current year wages according to Box 1 of their W-2.

2. Monthly Rate of Pay Method: Coverage will be considered affordable if the employee's share of the premium is no more than 9.86% of their monthly rate of pay.

3. Federal Poverty Level Method: Coverage will be considered affordable if the employee’s share of the premium is no more than 9.86% of the most recently published mainland Federal Poverty Level (FPL) for a household of one.

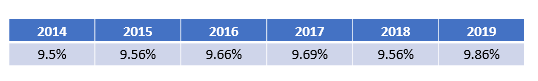

If you recall, the Employer Mandate was originally set to take effect in 2014, but it was delayed until 2015. The original 9.5% affordability percentage has been adjusted each year for inflation. A summary of the Employer Mandate affordability percentages since its inception has been provided below.

For more information about the Employer Mandate and how to calculate affordability, you can check out this previous blog post.

Have a question about the Employer Mandate? Ask the Expert!