Benefits Buzz

Are Your Employees Ready for Consumer-Driven Healthcare?

Consumer-Driven Health Plans (CHDPs) have been steadily gaining in popularity for several years now. According to the Society for Human Resource Management (SHRM) 2018 Annual Benefits Report, 40% of the employers surveyed now offer a CDHP to their employees. SHRM defines a CDHP as a Health Reimbursement Arrangement (HRA) or a Health Savings Account (HSA) paired with any underlying medical plan. In addition, 29% of employers surveyed offer a High Deductible Health Plan (HDHP) that is not linked to an HSA or HRA.

The central tenet of Consumer-Driven Healthcare (CDH) is that when employees have a greater involvement in their healthcare finances, they will make better decisions. But is that actually the case? Are employees really ready to step up and take more responsibility for their healthcare? Do they have the foundation of financial knowledge and habits necessary to make CDH work for them?

Alegeus, a market leader in consumer-directed healthcare solutions, recently commissioned an independent survey of more than 1,400 U.S. healthcare consumers to try and answer that very question. They didn’t just want to know if consumers understood basic healthcare terminology—they wanted a complete picture of their starting points, behaviors, and fluency in healthcare and finance.

Here is what they learned.

Consumers lack basic financial skills

Alegeus believes that in order to stay on top of their healthcare finances, it’s essential that consumers develop basic financial habits. Their survey found many consumers don’t have a strong handle on their finances and they aren’t confident in their ability to save for healthcare costs.

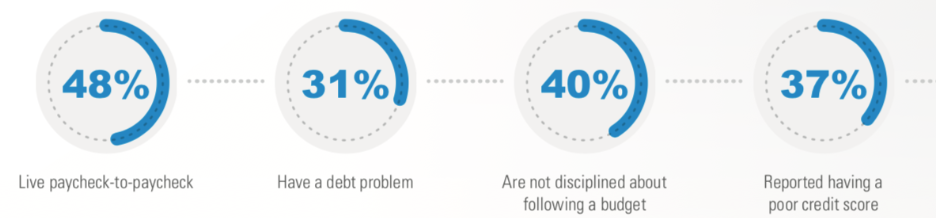

Of the respondents to their survey:

These results are problematic for healthcare consumerism, which requires consumers to be disciplined about their savings.

Unfortunately, the survey found that a high proportion of consumers are undisciplined about savings in general. Of the respondents to the survey, 50% said they were not disciplined about saving for retirement and 51% reported they have no emergency savings at all.

It's fair to say that if consumers aren’t saving in other important areas of their lives, then they’re unlikely to save for their healthcare needs.

Healthcare fluency is still low

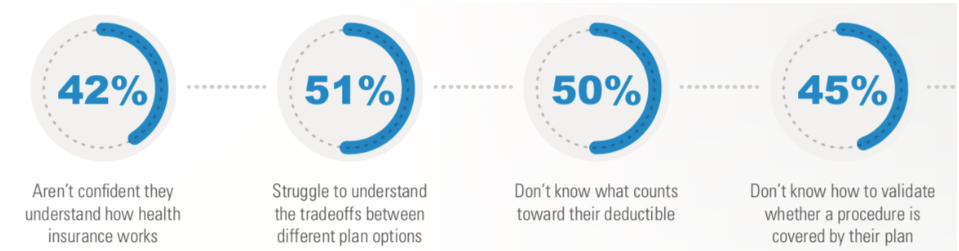

The survey results also highlighted a definite lack in understanding of basic healthcare concepts.

For example, of the respondents:

Even when consumers believe they understand healthcare, the reality is often quite different. Alegeus found that, while 66% of respondents felt confident in their understanding of basic insurance terminology, only 50% correctly answered a simple true/false test about premiums and deductibles.

What’s more, Alegeus has found that this lack of understanding to be magnified when it comes to health benefit accounts, such as Health Savings Accounts (HSAs). Of the general population, Alegeus reports that only 19% of people can pass a basic ten-question proficiency test on HSAs, compared to 29% for Flexible Spending Accounts (FSAs). Those numbers do go up amongst individuals currently enrolled in those accounts…but only to 35% and 37%.

That’s right. Around two-thirds of people currently enrolled in an HSA or FSA simply do not understand their account.

According to Alegeus, it’s not just lack of understanding that’s getting consumers into trouble. Many people still struggle to predict how much they will need to spend out-of-pocket on their healthcare expenses:

- 55% can’t predict the amount of healthcare services they’ll consume this year

- 51% can’t forecast likely out-of-pocket costs for this plan year

- 58% don’t know or understand how much healthcare will cost in retirement

There is hope for the future

This is not to say that healthcare consumerism is doomed. The survey did highlight a few positive behaviors that can be built upon.

First of all, 82% of respondents were able to track their spending, with 75% reporting that they are able to curb impulse spending when necessary. More than half had established clear financial goals. While these may seem like fairly basic financial behaviors, they do demonstrate an understanding that financial planning is an essential part of modern life.

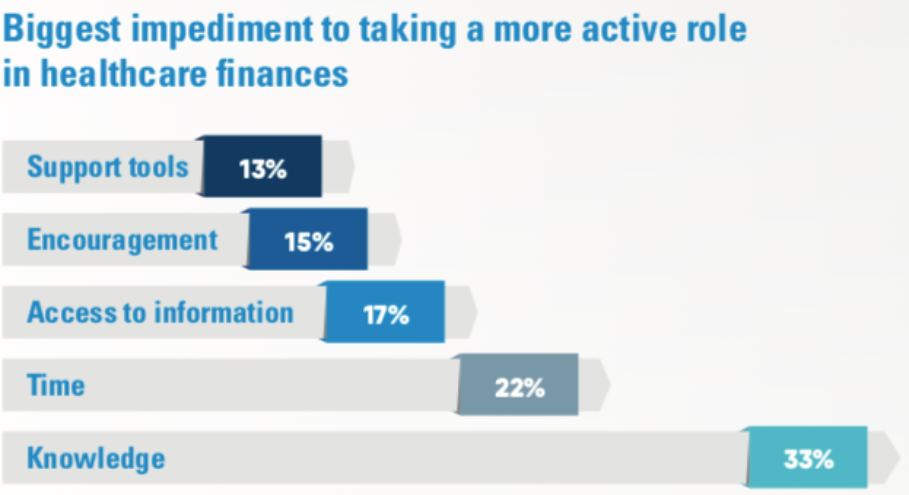

40% of respondents indicated that they want to take a more active role in their healthcare and highlighted key areas in which they would need support:

Unsurprisingly, knowledge was highlighted as the single greatest barrier for consumers who want to take a more active role in their healthcare finances.

Finally, Alegeus saw real cause for optimism in responses from consumers who have already joined the CDH movement. Respondents enrolled in HSAs displayed much higher than average levels of understanding and behavior.

Where do we go from here?

As CDHPs continue to grow, Alegeus’s research results clearly demonstrate that consumers feel the impact of their increased responsibility, and they struggle to manage it. Although consumers do have some basic financial systems and knowledge in place, many are not currently in a strong position to manage their healthcare finances.

Despite this, many consumers really do want to play a more central role in their healthcare journey. When you take into consideration the recent growth of CDHPs, this suggests that consumers are starting to understand the value of healthcare consumerism but are looking to employers and plan providers for increased support.

Your employees are looking for the education, tools, and support they need to make informed decisions about their health, wellness, and finances. So long as this help is available, the future of healthcare consumerism looks bright.

Have a question about Consumer-Driven Healthcare?