Benefits Buzz

Health Savings Account (HSA) vs. 401(k)

Posted on May 24th, 2018

Why employees should max out their HSA contributions

Most people don’t think about an HSA as a savings account. Instead, they think of it as an account used to set aside money, tax-free, to pay for healthcare expenses. While this is true, the reality is an HSA is much more than a bank account. It’s a long-term savings vehicle.

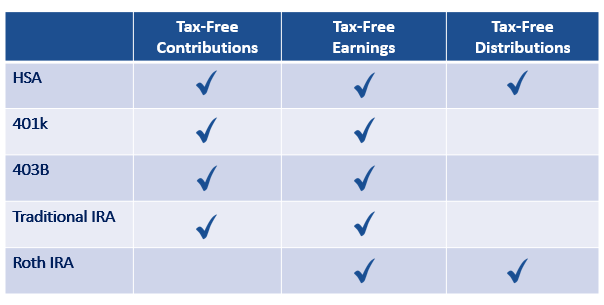

HSAs offer the greatest tax benefits – more than any other retirement account, including a 401k. How is this possible? It’s simple. With an HSA, employees can tap into the power of triple-tax savings. This means contributions to the account are tax-free, earnings are tax-free, and withdrawals for eligible healthcare expenses are tax-free.

Here's how HSAs stack up against traditional retirement plans:

As you can see, HSAs are the only account that offers these triple-tax savings. Plus, the funds in the account belong to the employee and roll over year to year, allowing employees to grow their accounts over time. Even better, they’re portable, so employees can take their HSA with them if they leave their employer.

How do HSAs help with retirement planning?

There is no doubt about it. Healthcare costs are on the rise and one of the biggest concerns when it comes to retirement planning. Studies show that a 65-year old couple leaving the workforce today can expect to need $260,000 to cover medical expenses during retirement. And this does not even include long-term care, which most of us will need at some point in our life.

So, the question is, are your employees taking the necessary steps today to ensure they are prepared for the future?

Directing savings to an HSA and maxing out their annual contributions helps ensure when health care expenses arise, they’re prepared. Not only will they have funds available, but those funds will be available on a tax-free basis. Employees who are fortunate enough to have good health and little need for healthcare-specific savings later in life can still access their HSA funds. They will just have to pay ordinary income tax on the distribution and wait until age 65 to avoid penalties.

The bottom line is there is no downside to maxing out HSA contributions. With healthcare costs continuing to grow, HSAs will become an even more important source of funds to pay for healthcare expenses. Make sure your employees are doing everything in their power to get the most value from their accounts and the triple-tax savings only an HSA can provide.

Do you have a question about HSAs? Ask the Expert!

Are you looking to set up HSAs for your employees? Request a proposal.