Benefits Buzz

- The Individual Mandate penalties increase to $695 per adult ($347.50 per child) or 2.5% of household income, whichever is greater.

- The Employer Mandate expands to include all employers who have 50 or more employees.

- The Employer Mandate offer rate increases from 70% to 95%.

- Employer reporting related to the offer of coverage is due for the first time during Q1 2016.

You may have thought the penalty for applicable large employers who fail to offer minimum essential coverage was $2,000 per employee. You may have also thought that if you offered coverage, but it was unaffordable and/or didn’t provide minimum value, then the penalty was $3,000 per employee who waived coverage and received a subsidy in the Exchange.

- Enroll in Part B for the first time in 2016; or

- Those who don’t currently receive Social Security benefits; or

- People who have Medicare and Medicaid, and Medicaid pays the Part B premium; or

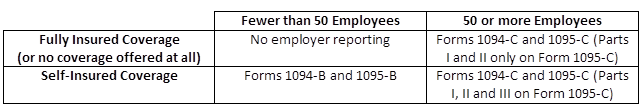

The new reporting requirements that some employers will be subject to starting next year, as required by the Affordable Care Act (ACA), will be used to help the Internal Revenue Service (IRS) enforce the Individual and Employer Mandates, and it will also help the IRS administer subsidy eligibility in the Exchanges.

The following reporting forms will be the responsibility of the employer to complete: