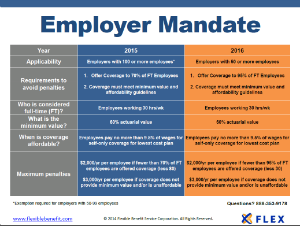

Employer Mandate

The IRS has released Notice 2015-17 with some new information about Employer Payment Plans, which are plans that are used to reimburse employees with pre-tax dollars for individual market coverage (e.g. HRA). Previous guidance had essentially eliminated Employer Payment Plans as an option for actively employed workers because they would not be able to comply with all of the Affordable Care Act (ACA) market reforms. Notice 2015-17 elaborates on the IRS’ position of Employer Payment Plans.

The IRS has released the final version of the forms and instructions as it relates to the new employer reporting requirements associated with the Employer Mandate and other Affordable Care Act (ACA) provisions. The forms are identical to the draft versions that were released last summer, but there have been revisions made to some of the instructions. The forms and instructions can be accessed below:

Section 6055 reporting (used to report which individuals are covered by the employer sponsored plan)

The Affordable Care Act (ACA) defines a small employer as one with up to 100 employees, but the law gave states the ability of using a definition of up to 50 employees until the end of 2015. As a result, most states, including Illinois, used a definition of up to 50 employees. However, that will change in 2016, and all states will be required to classify their small group market as up to 100 employees.

Why does this matter?

Minimum Essential Coverage and Minimum Value are two terms that are mistakenly considered the same by many people, but in fact, these terms have different definitions.

Minimum Essential Coverage is the type of coverage needed to satisfy the Individual Mandate requirements. The most common forms include the following health plans:

Yesterday, IRS officials made a significant announcement that impacts the Employer Shared Responsibility requirements, also known as the Employer Mandate. New guidance issued by the IRS confirms that a new phased approach will be utilized to implement it.

The new approach has 3 significant changes to the previously written rules:

The Exchanges are supposed to have verification systems in place to help determine if an enrollee has access to affordable health insurance coverage from their employer. Since the Employer Mandate reporting requirements are being delayed until 2015, the Exchanges won't have this verification system in place next year.

Instead the Exchanges will have to rely on self-reporting for this information in 2014.

By this time you have probably already heard that the Employer Mandate has been delayed until 2015. In simple terms, no employer will be penalized in 2014 for failing to offer health insurance (or failing to offer affordable health insurance).

Here are 5 key ACA items for employers to know.

The U.S. Department of Treasury announced on Tuesday that the Employer Mandate will be delayed until 2015. This rule is also commonly referred to as the Employer Shared Responsibility requirement or the Pay or Play provision.

The Employer Mandate was set to impose financial penalties starting in 2014 on employers with 50 or more full-time equivalent employees that failed to offer health insurance to employees, as well as those employers that offered health insurance that was considered unaffordable.