Benefits Buzz

Last year, the State of Illinois passed a law called the Consumer Coverage Disclosure Act (CCDA). The CCDA requires a written disclosure to be provided by every employer who has employees in the State of Illinois and who also provides group health insurance coverage to those employees.

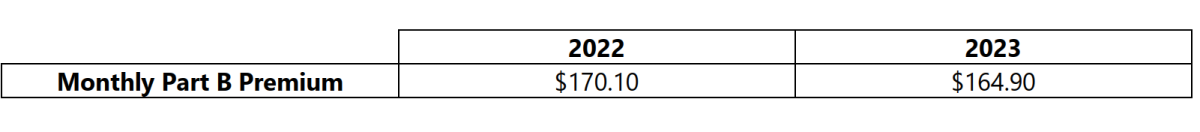

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers: