cafeteria plan

Many employers offer a cash payment to employees who waive health insurance coverage. These cash payments are always taxable to employees who waive health insurance coverage, but did you know employees who elect the health insurance coverage may be subject to paying taxes on the cash payment that they didn’t receive?

Wait! What?

Premium Only Plans (POP) can generally be defined as a type of Cafeteria Plan where the only pre-tax benefit available to employees are for those of insurance premiums. Now, whenever non-taxable benefits are involved, the IRS will usually have some strict rules in place that must be followed. For Cafeteria Plans, these are referred to as non-discrimination rules, and these rules are in place to ensure the plan doesn’t discriminate in favor of highly compensated and/or key employees.

What happens to Health and Dependent Care FSAs when a merger or acquisition occurs?

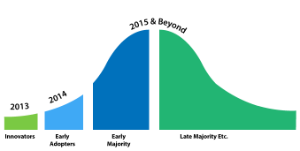

After nearly thirty years of lobbying the “Use-It-or-Lose-It” rule has been changed. Now the option is left to you, the plan sponsor, whether or not it is the right thing to implement for your company. Let’s take a look at some of the scenarios and helpful tips for the healthcare flexible spending account (FSA) rollover option in terms of an adoption lifecycle (a model that shows the trend of acceptance to a new concept over time).

As tax season comes to a close, you might be wondering how to save more next year. Flexible Spending Accounts (FSAs) are a great tool that allows you and your employees to save on healthcare and dependent care expenses. Celebrating 25 years as a trusted benefits administrator, we have done the math to help you visualize your potential savings with our FlexFSA® product:

In their own words, politicians on either side of the fence agree that the middle-class is hurting.

“Middle-income families are being crushed.” – Mitt Romney

“The Middle Class has been buried.” – Joe Biden

A hot topic during the 2012 presidential election has been health care reform and the Affordable Care Act (ACA). American workers are paying more out of their pocket for health care expenses than ever before. No matter which party line you side on – everyone seems to agree that the financial burden carried by the middle class is disproportionate in one way or another.