Producers

Reporting requirements from the Affordable Care Act (ACA) are rapidly approaching. Health Insurance Marketplaces, health insurance carriers, and employers may be subject to the reporting. The reporting is due February 28, 2023 if filing manually and by March 31, 2023 if filing electronically. Electronic filing is required for entities that are filing 250 or more forms.

Let’s get to the ABCs of the reporting.

The Centers for Medicare and Medicaid Services (CMS), the federal agency that largely oversees the Health Insurance Marketplace (Marketplace), has indicated that agents and brokers who assist with Marketplace enrollments must obtain client consent before assisting with enrollments and other Marketplace functions.

Earlier this year, the Centers for Medicare & Medicaid Services (CMS) published some new compliance rules that will impact Third-Party Marketing Organizations (TPMOs) who sell Medicare Advantage and/or Part D plans.

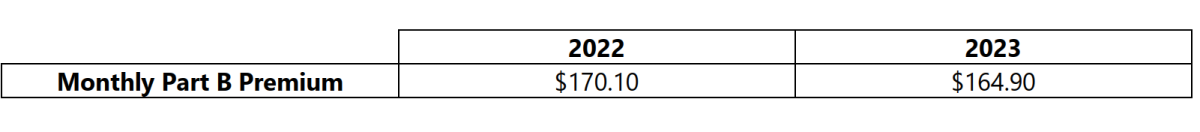

On September 27, 2022, the Centers for Medicare & Medicaid Services released the 2023 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs, and the 2023 Medicare Part D income-related monthly adjustment amounts. Below is a summary of those numbers:

Advanced Premium Tax Credits (APTCs)

The COVID-19 national emergency was set to expire on July 15, 2022; however, a 90-day extension of the national emergency was issued, and the national emergency is now set to expire on October 13, 2022 (absent another extension).