FSAs

What happens to Health and Dependent Care FSAs when a merger or acquisition occurs?

- The fee is paid on the average number of covered lives for the plan year ending in 2014.

The Affordable Care Act (ACA) created the Patient-Centered Outcomes Research Institute (PCORI) as a way to help improve clinical effectiveness. The research institute is partially funded by fees charged to health plans, including some Health Reimbursement Arrangements (HRAs) and some Flexible Spending Accounts (FSAs). The fees are payable over a seven year time period and started for the first time last year.

The next round of PCORI fees are due to the IRS by July 31, 2014 and are payable via Form 720 by applicable employers for plan years ending in 2013

On June 1, 2014, same-sex marriage became legal in the state of Illinois. As a result, we wanted to revisit marriage as a qualifying event for health insurance coverage and discuss how account-based health plans are impacted.

Can an individual be covered by more than one “Flex Plan” at the same time?

Yes, Health Care Flexible Spending Accounts (FSAs), Health Reimbursement Arrangements (HRAs) and Health Savings Accounts (HSAs) can be combined in certain circumstances.

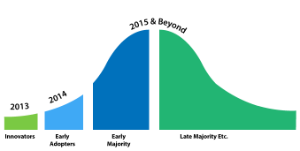

After nearly thirty years of lobbying the “Use-It-or-Lose-It” rule has been changed. Now the option is left to you, the plan sponsor, whether or not it is the right thing to implement for your company. Let’s take a look at some of the scenarios and helpful tips for the healthcare flexible spending account (FSA) rollover option in terms of an adoption lifecycle (a model that shows the trend of acceptance to a new concept over time).