Employee Benefits

Each year on April 2, the International Foundation of Employee Benefit Plans (IFEBP) champions the effort to recognize all those who participate in the employee benefits industry and their hard work. As an IFEBP member, Flexible Benefit Service LLC (Flex) wants to thank you for your business and remind you to participate in the festivities, as well.

When it comes to Health Savings Accounts (HSAs), one of the most common questions we hear is, “Can people aged 65 and older contribute to an HSA?” Many people would answer no to this question, but that is not always the case.

The fact that someone turns 65 does not automatically disqualify him from making contributions to an HSA, but enrollment in Medicare does.

An employer can be fined up to $100 per day for every employee that had a waiting period in excess of 90 calendar days.

The Affordable Care Act (ACA) imposes a new rule that group health plans cannot have a waiting period of more than 90 calendar days.

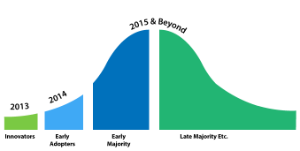

After nearly thirty years of lobbying the “Use-It-or-Lose-It” rule has been changed. Now the option is left to you, the plan sponsor, whether or not it is the right thing to implement for your company. Let’s take a look at some of the scenarios and helpful tips for the healthcare flexible spending account (FSA) rollover option in terms of an adoption lifecycle (a model that shows the trend of acceptance to a new concept over time).

Recent guidance helped clarify some of the confusion about Patient-Centered Outcomes Research Institute (PCORI) fees applicable to Health Reimbursement

Arrangements (HRAs) and Flexible Spending Accounts (FSAs). It was originally thought that the fee would be applicable to all covered lives including spouses and dependents. That is no longer the case in some instances.

The U.S. Department of Health and Human Services (HHS) and the Internal Revenue Service (IRS) have jointly issued rules that define affordable coverage. Employers and employees still have several questions about how this affects penalty calculations and subsidy eligibility.

The following offers some insight on these key issues:

Between lengthy meetings at the office, frantic shoppers and frenzied holiday music, it can be hard to stay focused on the fact that the year is coming to a close. In fact, with all the water cooler talk about the world ending it is even anticlimactic.

If you have a flexible spending account (FSA), the year-end FSA frenzy is here. FSA participants that may have contributed too much money may be in panic mode, but it does not have to be that way for you. Let’s take a look at some ways to use your FSA money.

Visit your:

- Doctor to make sure to get all immunizations done.

- Dentist/Orthodontist to get a check up on those pearly whites.

- Optometrist to get an eye exam! Buy a new pair of eyeglasses, prescription sunglasses, contact lenses, or even stock up on contact lens solution.

- Dermatologist to get prescriptions, such as acne treatments.

Opportunity's always knocking. Just open the door.

If everyone knows that a bird in the hand is worth two in the bush, then why isn’t cross-selling a universal practice? Cross-selling is a great tool for client retention, as well as prospecting. Your clients and prospects may not be aware of the full portfolio of your offerings.

So, don’t think twice about reviewing all options during the renewal/enrollment process. This is your opportunity to suggest how they can enhance their benefits program. And yes, even if they feel satisfied with what they offer currently.